BLOG

We work passionately to change the future with our young, dynamic, and creative team

Reycan Çetin // Growth Manager @Techsign

Introduction

The finance sector has strict regulations on online transactions to establish a secure environment. Maintaining security and safeguarding against fraudulent activities, money laundering, and financing terrorism is not crucial only for the finance sector and also for the well-being of society.

There are two crucial components in building security in finance. These are AML (Anti Money Laundering) and KYC (Know Your Customer) procedures. While both are integral levels of ensuring financial integrity and work together, they serve distinct purposes in the fight against illegal actions. And they create the protection of legitimate financial transactions in different steps.

In this blog, we will explore the differences between AML and KYC, their significance, and how they work in tandem to create a secure financial ecosystem.

KYC

Let's start with the basics. KYC is short for Know Your Customer. It is the process by which financial institutions verify the identities of their customers. The primary goal of KYC is to ensure that businesses be certain about their customers' identities, financial activities, and risk profiles. This helps to establish a transparent and trustworthy relationship between the customer and the financial institution.

Key Features of KYC:

Customer Verification: The most used and well-known KYC process is customer verification. The KYC process can involve different information about customers. It is shaped by firms' requirements, regional regulations, etc... Usually, the essential customer information, such as name, address, date of birth, and official identification documents (e.g., passport, driver's license, or national ID).

Risk Assessment: Financial institutions use KYC data to assess the potential risk associated with a customer's financial activities. This allows them to categorize customers as low, medium, or high-risk.

Ongoing Monitoring: KYC is not a one-time process. Financial institutions continually monitor customer transactions and activities to identify suspicious behaviors that may indicate money laundering or other illegal activities.

AML

AML is short for Anti Money Laundering. Money laundering is o disguising the origins of black money to make them appear legitimate. It is an important threat because the activities such as drug trafficking, corruption, embezzlement, or gambling are the resources of black money. And they can not be tracked when the black money is laundered. AML is a set of policies, regulations, and procedures that are set to detect and prevent money laundering. AML procedures are also crucial to prevent financing terrorism and other illicit financial activities.

Key Features of AML:

Detection of Suspicious Activities: AML procedures entail identifying and reporting transactions or activities that raise concerns about potential money laundering or illicit funding. These red flags need to be taken seriously to prevent illegal activities.

Reporting to Regulatory Authorities: Financial institutions are obligated to report any suspicious transactions or activities to the relevant regulatory authorities. It is a legal responsibility. And if they do not, they will be considered to be part of illegal actions.

Compliance with AML Regulations: Financial institutions must adhere to local and international AML regulations and stay updated on evolving AML practices and requirements.

The Relationship Between AML and KYC

While KYC and AML are distinct processes, they are closely related and work hand in hand to ensure financial security and compliance. KYC provides the foundation for AML by enabling financial institutions to verify customer identities and understand their risk profiles. This allows them to monitor customer transactions effectively and detect any unusual or suspicious activities, which are crucial components of AML.

In practice, KYC processes provide the necessary customer data that AML systems rely on to perform transaction monitoring and risk assessment. When AML systems flag suspicious activities, they often trigger enhanced due diligence processes in KYC to gather more information and investigate further.

Techsign's Role in AML and KYC Processes

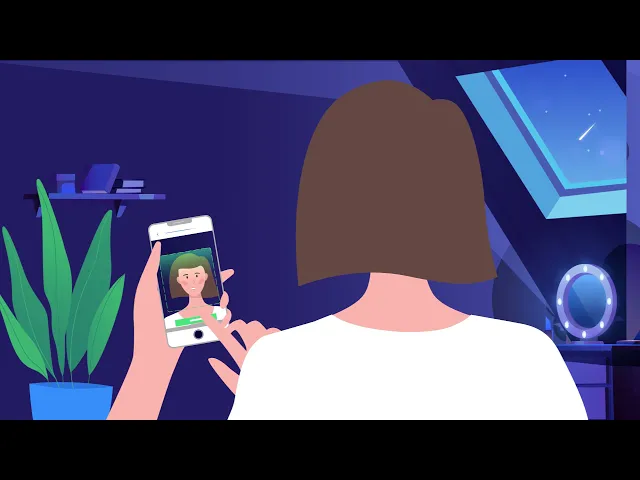

Techsign focuses on the customer verification part of the KYC process and provides financial institutions end-to-end KYC solutions. Secure, fast, and legally compliant. Standard customer verification is based on only document verification. And if you do it physically, it takes ages. But in Techsign's KYC solutions, remote customer verification is easy, fast, and secure.

Techsign does standard document verification but in a better way with the help of technology. Checks the ID card to detect fake ones, with a hologram or NFT check. And the used AU can learn any ID card just in one week: passports, residence permits, driver's licenses, national ID cards, etc...

And besides document verification, Techsign's KYC solutions offer biometric feature-based verification too. We know that most financial institutions use multi-factor customer verification in online onboarding. Such as something you own and something you are. Having your ID card is not enough, you also have to prove the identity you claimed with your biometrics. Face recognition is the most used biometric verification. And Techsign has an incredible score in this technology!

Another thing we can provide happily to our customers is being legally compliant. It is a hard job. Because the regulations and legal requirements are different across geographical regions. Techsign works with the biggest banks in Turkey and is used to their needs, processes, and legally binding measurements. And the solutions can be adapted easily for changes.

If you want to have further information, please contact us!

SHARE

BLOG