BLOG

We work passionately to change the future with our young, dynamic, and creative team

Reycan Çetin // Growth Manager @Techsign

Growing in the COVID-19 pandemic, remote customer onboarding processes have become a permanent reality in our lives. It helps to save time for both companies and users. However, these processes also pose significant security risks, which continue to grow as fraudsters use technology more efficiently.

To mitigate these risks, it is crucial to verify customers’ identity securely. Detecting fake and stolen identity cards and excluding bot users is vital for both the continuity of financial systems and the security of individual accounts. Over the past decade, governments and institutions have developed various methods to achieve this. And one of the most important methods used is agent calls.

Video Calls and Remote Know Your Customer

In remote identity verification processes, video calls fundamentally operate on the same principle despite slight variations across sectors and regions. According to the instructions, the customer shows the relevant identity card and their face to the camera. The authorized person conducting the video call examines different sides of the identity card, asks questions to the person, and ensures that the photo on the ID matches the customer. At the end of the process, the customer is approved to create an account or access their account.

This process may seem easy and highly secure for the user, but, it has some handicaps too. As technology evolves, it has become cumbersome and is ready to be replaced by new technology.

The Limitations of Video Calls

As mentioned, video calls were crucial in the initial stages of digitalization and the RKYC process to build a security wall. However, over time, this method has started to lose its effectiveness. Here, I will briefly discuss the limitations of this method and explain why new technologies are needed.

The Costs of Video Calls

The biggest handicap of video calls is certainly their cost, especially for companies with high transaction volumes. These costs can be broken down as follows:

Personnel Costs: Staff managing video calls require extensive training, which involves training expenses and salaries, posing a significant cost burden for companies.

Time Costs: Video calls typically take 2-2.5 minutes at best. Poor internet connections, misunderstandings, or repeated instructions can extend this to 5-6 minutes, necessitating either more personnel or longer wait times for customers.

Technological Infrastructure: High-quality video and audio communication needs a strong internet connection and advanced software solutions for both the customer and the agent. Otherwise, the call might drop before completion.

Deepfake and Identity Fraud Threats

The main advantage of video calls was their high-security element. However, with technological advancements, deepfake and other identity fraud techniques have become more sophisticated and convincing, diminishing the reliability of video calls. For more on deepfake, click here.

Beyond the Limits with AI Agents

We often remind that the most effective tool against AI-generated threats is AI itself. For more on deepfake, click here. Remote identity verification processes are no exception. AI agent technologies have the potential to revolutionize these processes by minimizing human intervention, reducing costs, and detecting fraud more efficiently than the human eye.

Here are some advantages provided by AI agents:

24/7 Operation: AI agents can provide uninterrupted service around the clock without the need for shifts or process management.

Speed and Efficiency: AI agents can perform identity verification processes quickly and efficiently, reducing the time per customer to as little as 45 seconds, thereby shortening customer wait times and speeding up transaction processes.

Advanced Fraud Detection: AI agents use advanced algorithms to detect deepfake and other fraud techniques, capturing details that the human eye might miss.

Lower Operational Costs: While AI agents require a high initial investment, they significantly reduce long-term operational costs by eliminating expenses related to personnel salaries, training, and other overheads.

AI Agents at Techsign

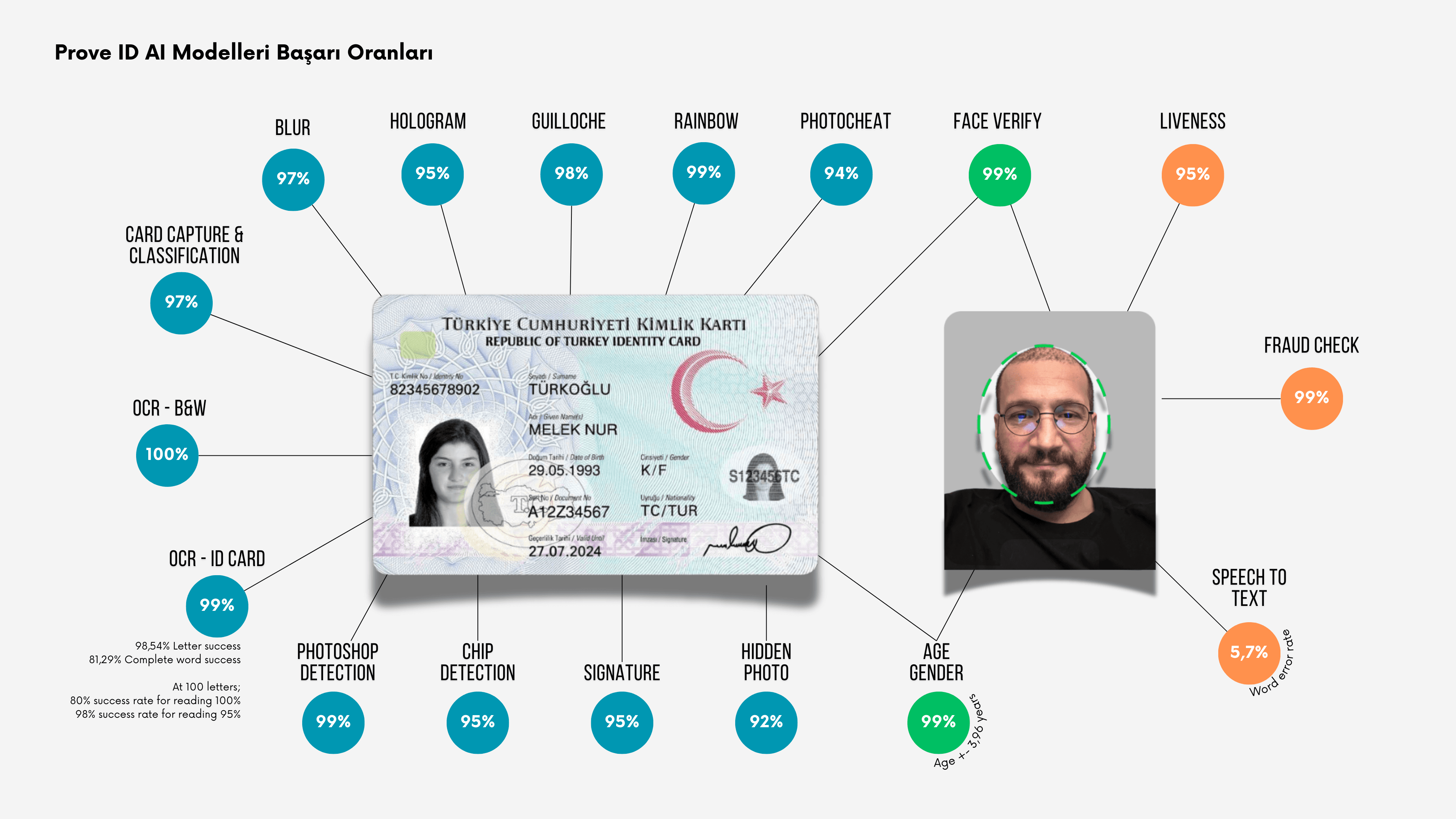

From day one, Techsign always focused on AI technologies in remote know-your-customer processes and now aims to lead AI agent technology in Turkey. By integrating multiple high-success-rate modules, Techsign’s AI agent can easily detect fraud attempts with high success rates even if they are invisible to the human eye. All of Techsign's modules boast over 95% success rates and comply with legal processes.

Contact us to free your company from the burden of video calls and create more efficient business processes.

SHARE

BLOG