BLOG

We work passionately to change the future with our young, dynamic, and creative team

Mehmet Nuri Aybar // Senior Business Development Consultant

Return on investment is one of the most important performance measures used to evaluate the profitability of an investment and a proven tool to compare the efficiencies of different investment opportunities.

It is the ratio between the benefit received as a result of the investment and the cost of the investment. In other words, it measures the amount of return on an investment, relative to the cost of the investment.

Since the profitability performance of business investments is measured by ROI, it would be better to mention the ROI of KYC & ID Verification solution, one of the most familiar post-pandemic investments performed by the technology, services, and platform companies. So, business owners and decision-makers can proceed by having a clean conscience about their KYC solution decisions.

When it comes to the ROI of a KYC & ID Verification solution, we can talk about the following main benefits:

Digitalization

Effectiveness & Productivity

Security

Interoperability

The combination of the innovative features under these items makes companies or organizations make strategically prominent decisions by creating digital transformation solutions. So, KYC & ID Verification solutions drive the differentiation by changing the way of the creation of both customer value and financial value.

A single KYC compliance check can cost between $14 and upward of $140.

KYC processes in banking cost the average bank $55 million per year.

In the UK alone, an estimated 20%+ of customer applications are abandoned due to KYC friction.

Let’s check these items one by one to define the value created or improved in a detailed way:

Digitalization

The KYC & ID Verification solution can be used for the complete digitalization of the

Customer Acquisition and

User Verification

processes. The tasks that can be done by a call center, customer care agent, or teller in a traditional brick-and-mortar business or the other type of flows which cannot provide 100% accuracy during the process without a KYC solution, transform into

More reliable

Quick

Low-cost

processes after the deployment of this solution.

So, for companies and organizations, it will be possible to change the focus of one of the most expensive resources - human resources - to more important and demanding business functions with the help of digitalization.

We can give the finance business as an example. In traditional businesses, the company needs manual control to check the customer’s ID document to verify whether the ID document is real and whether it belongs to that customer or not during the onboarding process. Manual control of this step is making the company establish a field team to reach the customers if not oblige them to have a brick-and-mortar business.

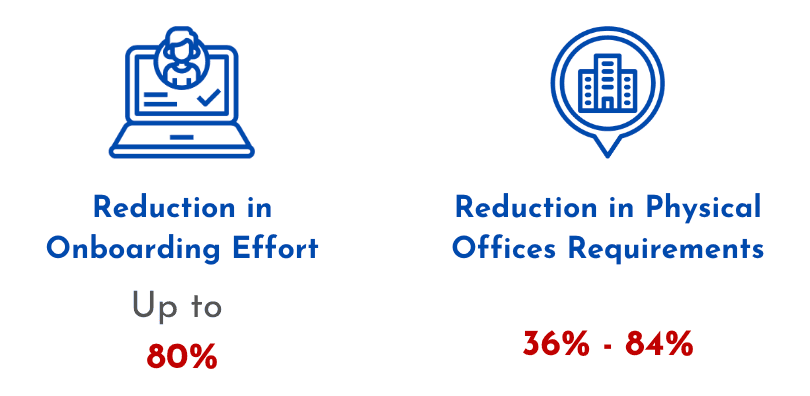

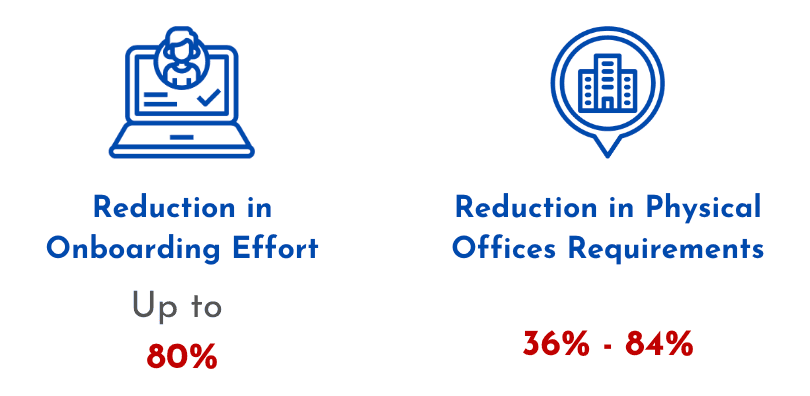

Digital and online processes are great advantages in terms of reducing or even eliminating some fixed and variable costs. When we think about the return on investment figure of the KYC solution or bigger solutions which include the KYC modules for the digital onboarding processes we can see impressive results.

Effectiveness & Productivity

Especially after the COVID-19 pandemic, KYC solutions started to be popular in terms of remote transactions. Primarily, banking and finance businesses accelerated the projects in digital onboarding which include KYC solutions providing the capability of acquiring and verifying the customers and users remotely.

On the other hand, in the existing situation with the digital business transformation requirements, the KYC solution became a basic step for any kind of platform or application in the digital world for secure accessibility in many businesses besides banking and finance.

The successful results obtained in banking and finance, e-money or e-payment, cryptocurrency, and asset management businesses make healthcare, e-commerce, EVI, sharing platforms, online marketplace for services platforms, tourism, etc. businesses start digitalizing their processes with KYC solutions.

First, during the customer and user acquisition or verification processes the KYC solution improves the flow time which is a valuable indicator of process performance by providing high-level security with AI-powered digital controls of the security elements on the ID document, face recognition, and liveness detection procedures.

Secondly, depending on the success of the solution, the number of acquired or verified users can be increased.

So, the KYC solution supports ROI with the improvements in

Capacity

Productivity

Efficiency

competencies and also does it in a data-focused way which will be useful in continuous improvement to create sustainable competitive advantages.

Related content: Difference between AML and KYC

Security

KYC solution is also a cyber-security solution that is designed to include many powerful security controls to protect the platforms, applications, or processes that integrate the solution into their systems.

KYC solution performs ID verification, face recognition, and liveness detection tasks with an AI process working parallel to the KYC solution. So, it creates a powerful protection mechanism against fraud attempts and decreases the cost that they can cause. Preventing costs with increasing benefits also contributes to the ROI of the KYC & ID Verification Solution investments.

Interoperability

In today’s business world which is being designed and shaped again with the digital business transformation dynamics, being

Lean

Easy to Integrate

Mission-Oriented

is an imperative for business applications.

KYC solutions that meet these expectations can again support the ROI with decreasing costs and increasing benefits in terms of

Modularity & Flexibility,

Fast and Easy Integration,

Low Integration Costs

KYC solutions can provide a breath of fresh air for many types of businesses in many fields with the benefits that we mentioned above under the four items. Even businesses that are not considering the KYC solution for improvement purposes today, may discover ways for getting benefit from it with the changing way of value creation within the context of the digital business transformation.

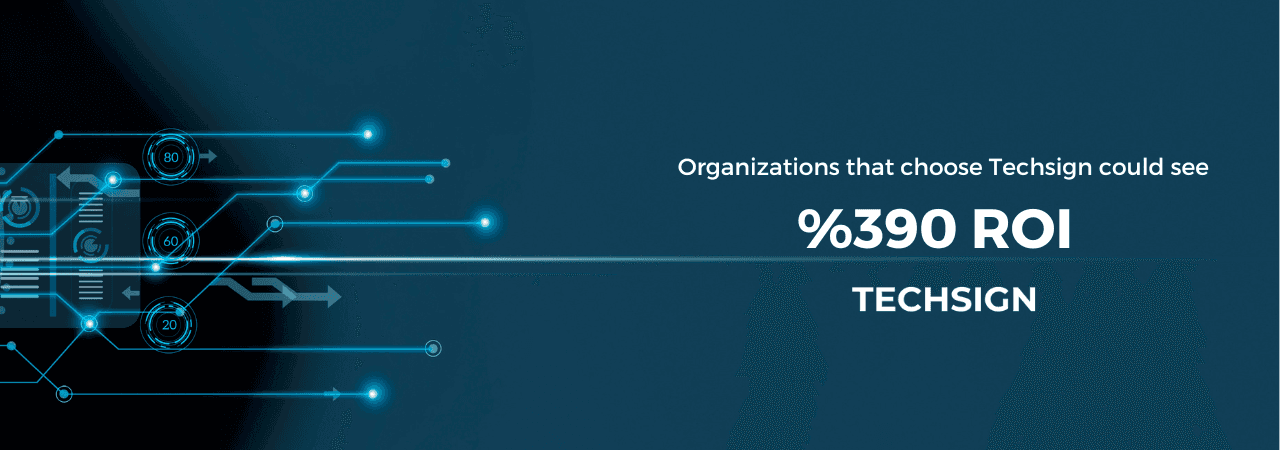

Techsign – High Return on KYC Investment

In this journey, Techsign teams work with companies to help them design solutions based on KYC & ID Verification for improvement or transformation in their businesses.

Techsign provides AI-powered KYC & ID Verification solutions which are having following key features:

Compliance with Global Regulations

Easy Integration

Modularity & Flexible Process Design

Smart ID & Profile Assessment

with highly talented technology and business teams.

Techsign also uses priceless experiences that were obtained to improve the solution day by day with a continuous improvement mindset not only to meet but also to discover the requirements and expectations of the customers.

Techsign KYC & ID Verification Solution can also be easily integrated with other Techsign solutions;

Techsign Biometric Digital Signature

Techsign Smooth Pass

Techsign Pay by Face

to enrich E2E digitalization and digital business transformation solutions for customer requirements in all businesses.

Techsign is working to create value for businesses, people, and the environment and waiting to come together to share it with you…

SHARE

BLOG